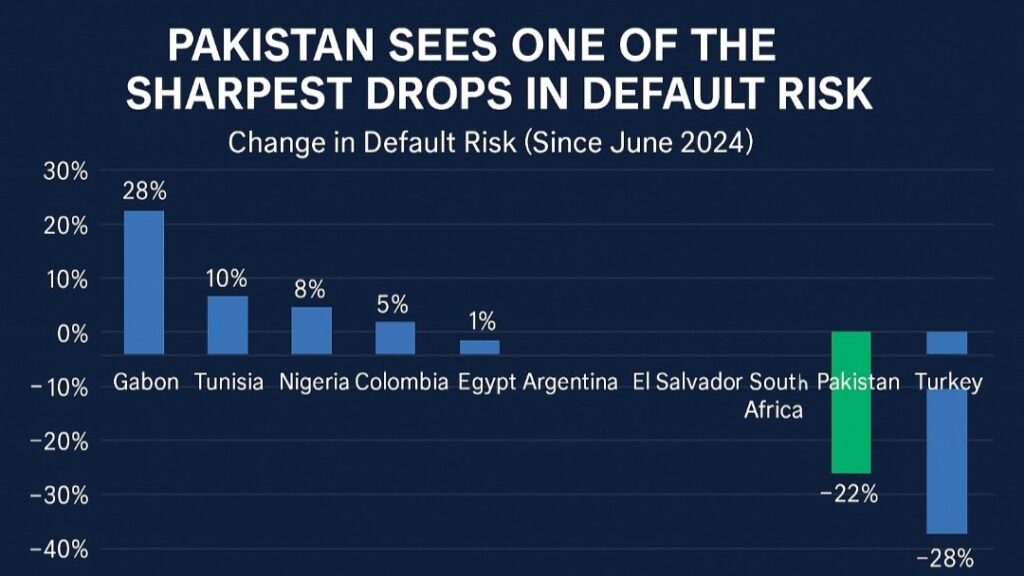

Adviser to the Finance Minister, Khurram Shehzad, stated on Sunday that Pakistan has recorded the second-fastest reduction in default risk among emerging markets, trailing only Turkey.

Citing a Bloomberg report in a post on ‘X’, Shehzad said the country recorded a 22 percent reduction in sovereign default risk—as measured by the CDS-implied default probability—over the last 15 months (June 2024 to September 2025).

He noted that this 22 percent decline is the fastest among major emerging markets and stands in contrast to countries like Argentina, Egypt, and Nigeria, where default risks are increasing. Shehzad attributed this reduction in default risk to the strengthening of investor confidence in Pakistan’s economy.

He added that investor confidence improved following structural reforms, timely debt repayment, staying on track with the International Monetary Fund (IMF) program, and positive ratings from global agencies. Shehzad affirmed that Pakistan is consistently restoring its credibility in the market, adding that the country is standing out as one of the most improved sovereign credit stories in the world of emerging markets.

This reduction in default risks comes amid Pakistan’s ongoing negotiations with the IMF. Earlier this month, Federal Minister for Finance and Revenue, Muhammad Aurangzeb, said that talks with the IMF were heading in the “right direction.” Expressing satisfaction with the pace of negotiations with the Washington-based lender, the Finance Minister said the government was confident that Pakistan’s tax-to-GDP ratio would increase to 11 percent.