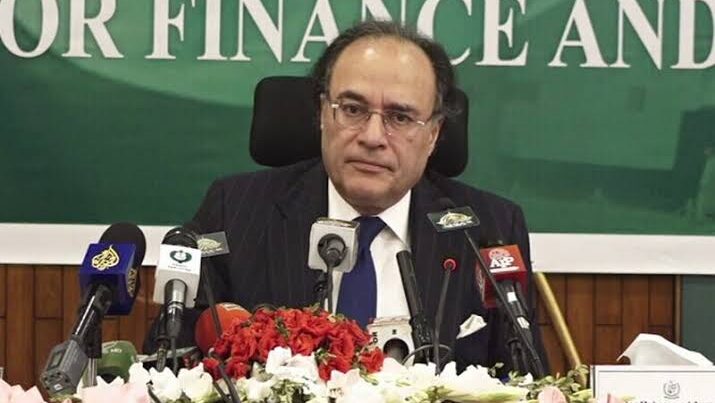

Pakistan’s Finance Minister Muhammad Aurangzeb warned on Wednesday that the government may need to impose an additional Rs400-500 billion in taxes if parliament fails to approve proposed restrictions on financial transactions by individuals deemed ineligible.

The warning came a day after the government unveiled a budget including approximately Rs432 billion in new taxes targeting the digital economy, solar panels, and fuel.

Aurangzeb stressed that without the passage of legislation restricting transactions by those lacking sufficient financial resources, the additional tax burden would be necessary.

He stated that the IMF has acknowledged the potential for Rs389 billion in additional revenue through improved enforcement, contingent upon the passage of new legislation.The proposed restrictions would ban ineligible individuals from purchasing or registering vehicles, transferring property, investing in securities, and opening certain bank accounts.

Eligibility would be determined by holding assets worth at least 130% of the intended purchase value.The minister also defended the decision to maintain the minimum monthly wage at Rs37,000 while simultaneously advocating for a significant salary increase for parliamentarians to account for inflation. He justified the increase by noting that it’s been nine years since their last adjustment, drawing a parallel to annual increments for government employees.

The press conference was briefly interrupted by protesting reporters who had not received a briefing from the Federal Board of Revenue (FBR) on the Finance Bill. The minister apologized for the oversight. The unusual tax structure on online shopping, with varying rates based on transaction value, was also noted as potentially encouraging cash-on-delivery transactions.

The minister also highlighted the government’s efforts toward an export-led economy through tariff reforms. He emphasized that while this would involve reducing import duties, it was a necessary step toward long-term economic growth. The government also addressed upcoming Eurobond repayments, stating that they are prepared to meet their obligations.